Community info and helpful resources

Blog

Featured Article

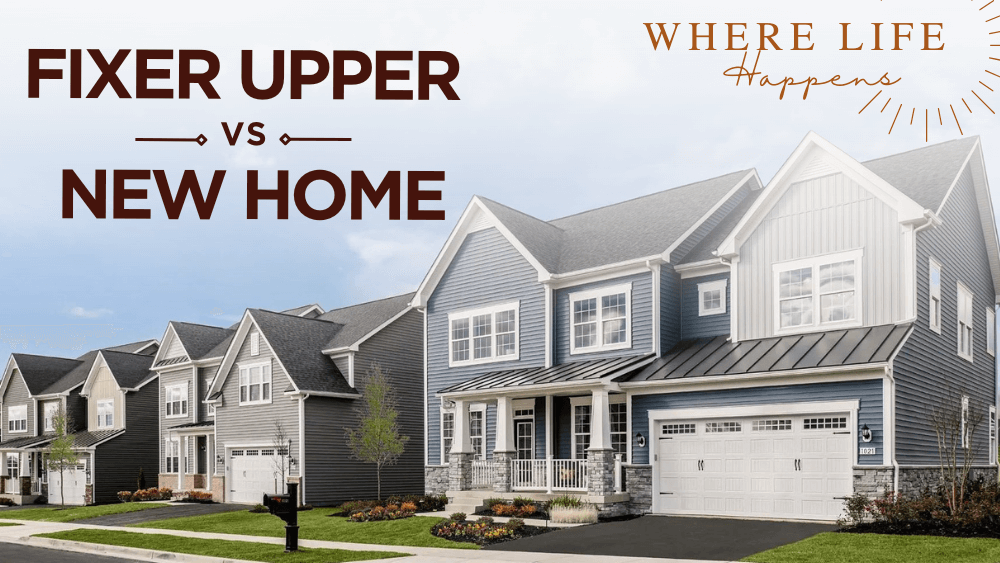

On the surface, a fixer-upper might seem more affordable, but it’s important to consider the hidden costs and challenges of renovating an older home.

Recent Articles

The holiday season is a time for joy, traditions, and family fun. When your home is in a place like Brunswick Crossing, the season becomes even more enjoyable. This planned community is not just about nice single-family homes. It’s about living in a place where comfort, connection, and convenience meet.

Why It’s Time to Find Your Forever Home at Brunswick Crossing

The holiday season is when we think most about home. We want comfort, space, and time with the people we love. We want a home that feels warm and welcoming, where we can build memories and traditions.

If your current home feels too small or doesn’t give you long-term ...

When the days get shorter and the leaves begin to turn, something special happens at Brunswick Crossing. Fall doesn’t just arrive — it becomes part of your everyday life. Front porches fill with pumpkins, walking trails transform into tunnels of color, and neighbors come outside to enjoy the crisp air together.

Discover Your Destination Home with Confidence

Touring a model home is one of the most exciting steps in your homebuying journey. With DRB Homes at Brunswick Crossing, you're not just looking for a house, you’re discovering your Destination Home. But to make the most of your visit, you’ll need ...